Introduction: A Nation in Turmoil

Argentina is currently grappling with significant political unrest, a situation that has been exacerbated by the soaring influence of cryptocurrency within its economic framework. The country has witnessed dramatic shifts in leadership, with Javier Milei emerging as a controversial figure at the helm of this turbulence. His approach to governance, characterized by a controversial embrace of cryptocurrency, has sparked both fervent support and strong opposition.

In light of Argentina’s ongoing economic struggles, Milei’s alignment with the crypto landscape has attracted considerable attention, drawing scrutiny towards allegations of cryptocurrency fraud. These accusations have raised critical questions about the legitimacy and stability of digital currencies in a nation desperate for financial solutions. The notion that cryptocurrencies could provide an escape route from hyperinflation and economic instability has been overshadowed by risks associated with potential fraud, leading to widespread outrage and uncertainty among the populace.

The ramifications of this crypto trend are profound, intertwining not only with the nation’s economic policies but also its socio-political fabric. As the political climate continues to heat up, the stakes have never been higher for the government and its citizens alike. The specter of a crypto collapse looms large, putting even more pressure on Milei’s leadership, which is already viewed through a lens of skepticism. Understanding how cryptocurrency has intertwined with Argentina’s leadership crises is essential for grasping the broader implications of this financial frontier. Indeed, the debate over crypto’s role in the economy is ongoing, with an emphasis on ensuring that it serves the interests of the people rather than degenerating into a conduit for fraud and exploitation. Given the current political uncertainty, the evolution of this situation warrants close attention and analysis.

The Genesis of Controversy: Cryptocurrency in Argentina

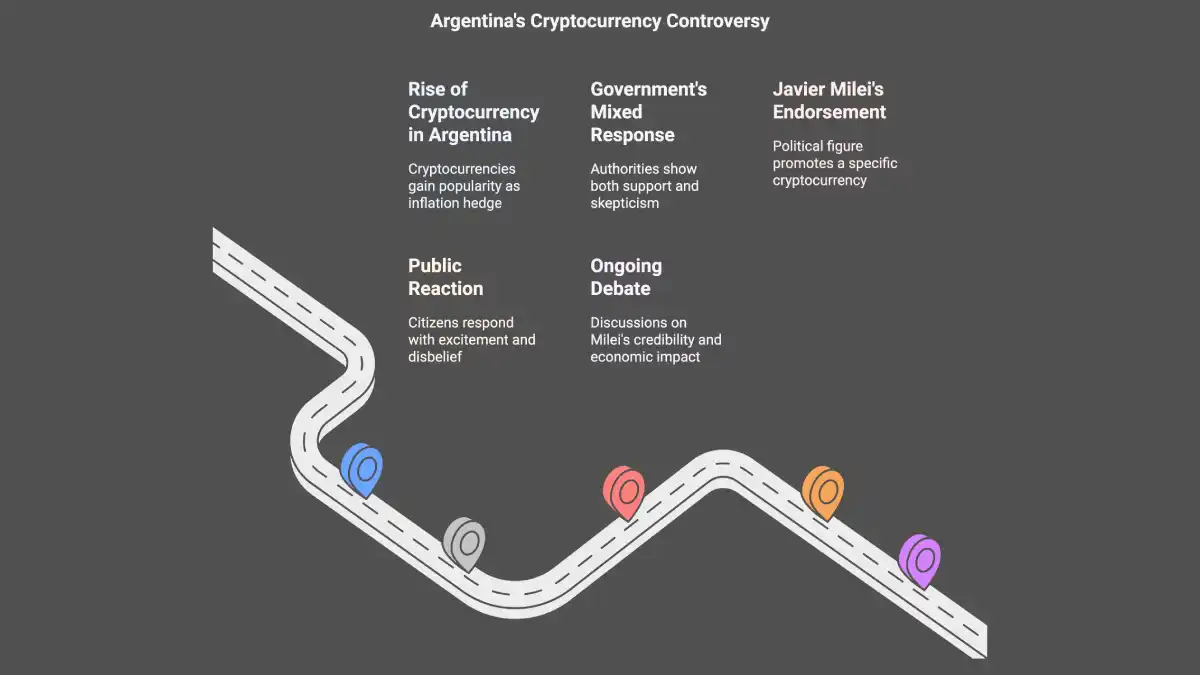

In recent years, Argentina has experienced a remarkable rise in the popularity of cryptocurrency, attracting significant attention from both the populace and the government. The initial allure of digital currencies like Bitcoin was rooted in their promising potential to provide a hedge against inflation, a perennial issue that has increasingly plagued the Argentine economy. With the peso losing value rapidly, citizens turned towards cryptocurrencies in hopes of preserving their wealth and gaining financial stability.

The government’s response to this burgeoning interest in digital assets was, at times, a mix of encouragement and skepticism. Regulatory bodies acknowledged the benefits of embracing a decentralized monetary system while also grappling with the challenges posed by potential cryptocurrency fraud. As the digital asset market evolved, a segment of the population came to see cryptocurrencies as not only a new avenue for investment but also a means to participate in a global economy devoid of restrictive monetary policies.

Enter Javier Milei, a political figure known for his unorthodox views and fervent libertarian approach. Milei’s endorsement of a specific cryptocurrency ignited the current political firestorm, catching the attention of both advocates and critics. His assertion that adopting this digital currency could lead to a reduction or even elimination of the peso was met with both excitement and disbelief among Argentinian citizens. While some viewed this as an innovative approach to tackling ongoing economic woes, others warned of potential risks, including the looming threat of a crypto collapse or increased instances of cryptocurrency fraud. The endorsement fueled debates around Milei’s credibility and intentions, drawing significant public scrutiny and highlighting the broader implications for the nation’s financial framework.

This burgeoning controversy reflects not only the dynamics of cryptocurrency in Argentina but also the complexities of integrating such innovations into traditional economic systems, setting the stage for further political and financial discourse in the future.

Reuters’ Exposé: The Impeachment Threats

The recent exposé by Reuters has shed light on the growing political tensions in Argentina following President Javier Milei’s controversial endorsement of cryptocurrency. This unexpected pivot towards digital currencies has not only raised eyebrows within financial circles but has also sparked significant backlash from the opposition, leading to calls for impeachment. The shift towards cryptocurrencies has been perceived by many as a reckless gamble, especially in a country grappling with economic instability and rising inflation. This endorsement has created a rift within political factions, with critics arguing that it undermines the established financial system and threatens the security of the Argentine economy.

Opposition leaders have seized upon the situation, asserting that Milei’s enthusiasm for cryptocurrency reflects a disregard for prudent fiscal management. They argue that his actions could lead to a complete crypto collapse, exacerbating the already precarious economic conditions faced by many citizens. The discussion around cryptocurrency fraud has entered the political arena, with fears that the president’s unregulated approach to digital currencies could open the door to illicit activities and financial exploitation of the populace. As tensions rise, the prospects for Milei’s presidency are beginning to look increasingly precarious.

Within this context, the threat of impeachment looms large, with various political factions galvanizing against the president. The potential for these impeachment proceedings reflects not only the discontent with Milei’s governance but also a deeper concern regarding the ramifications of his cryptocurrency policies. As public confidence wanes, mindful scrutiny of the administration’s approach to economic reform is paramount in evaluating the feasibility of such ambitious cryptocurrency initiatives. The political fallout from Milei’s decisions will undoubtedly continue to unfold, as the stakes rise for both the president and the Argentine population.

The New York Times Investigation: Unmasking the Fallout

The repercussions of the recent cryptocurrency collapse have drawn significant attention, prompting The New York Times to conduct an in-depth investigation into its aftermath. This investigative piece highlights the multifaceted fallout faced by investors, regulatory bodies, and the broader economic landscape in Argentina. As cryptocurrency fraud becomes increasingly prevalent, the findings of the investigation shed light on how this unfortunate event has led to severe financial losses for many individuals who believed in the promises of the cryptocurrency market.

In their report, The New York Times details the alarming rise in complaints lodged by investors who fell victim to deceptive practices associated with cryptocurrency. These cases illustrate the extent of the deception, revealing that many individuals engaged in investments often lacking proper due diligence, primarily as a result of the unregulated nature of the crypto market. Investors are now grappling not only with diminishing returns but also with the psychological toll that comes from feeling misled and betrayed by the very systems they trusted.

The investigation did not stop at individual losses; it further examined the impact on regulatory bodies. Authorities in Argentina are now under pressure to implement stringent measures to enhance oversight of the crypto sector, with the aim of preventing future incidents of cryptocurrency fraud. This entails developing comprehensive regulations to protect investors and ensure market stability, a task that policymakers are addressing with urgency following the crisis.

The implications of the cryptocurrency collapse extend beyond investor protections and regulatory frameworks. The broader economic landscape is also undergoing significant changes as a result of this turmoil. The failure of prominent crypto platforms and loss of investor confidence may influence Argentina’s economic policies, reshaping its approach to digital currencies. Thus, the fallout from this event serves as a pivotal point for the future of cryptocurrencies in the country and highlights the importance of fostering a more stable financial environment.

Bloomberg’s Revelation: The Deleted Tweet

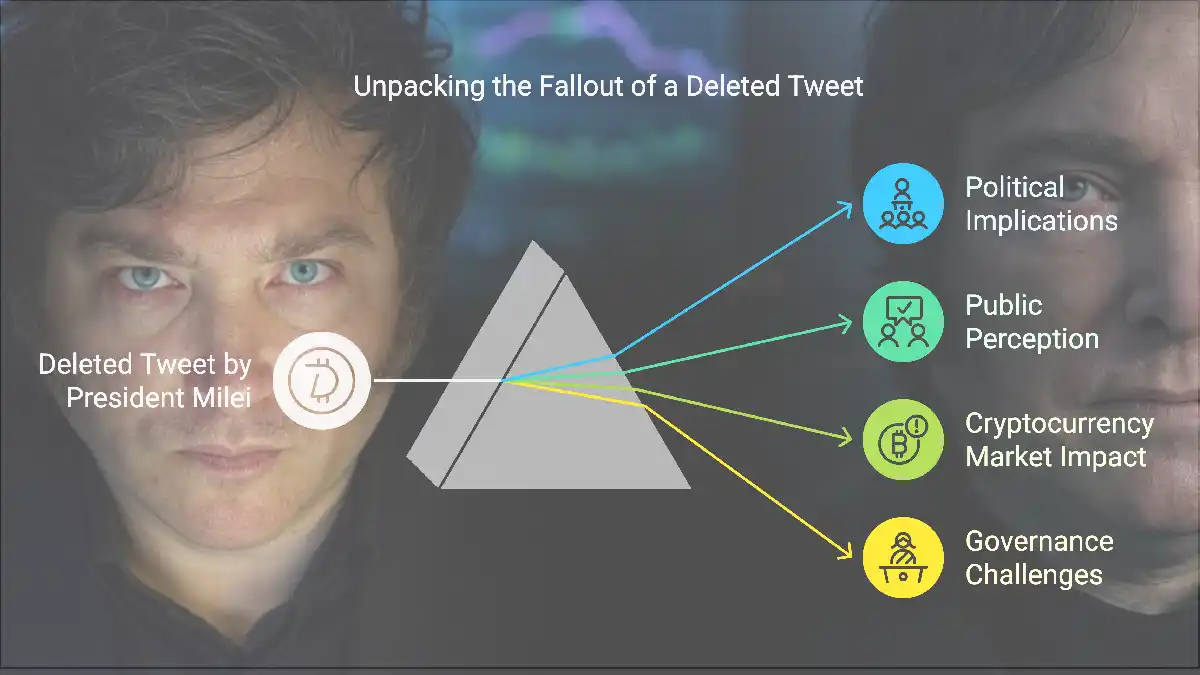

The recent incident involving President Javier Milei’s deleted tweet promoting a specific cryptocurrency token has sparked significant discussion regarding its implications for his administration and the broader context of cryptocurrency fraud in Argentina. This action can be interpreted as an attempt to distance himself from any potential fallout related to the crypto collapse that has adversely affected numerous investors in the country. By erasing this promotional content, Milei may inadvertently reinforce the perception that he is attempting to conceal responsibility for the consequences of his previous endorsement.

The timing of the deletion raises questions about the level of foresight displayed by the president, as the public and investors alike were eagerly analyzing his stance on the burgeoning cryptocurrency market. Milei’s tweet had initially been viewed as a signal of support for digital currencies, leading many to invest based on his endorsement. However, with reports of substantial losses following the collapse of certain crypto projects, the need to remove the tweet could suggest a growing awareness of the potential for backlash and scrutiny from both the electorate and the media.

This behavior aligns with a narrative of political recklessness, as it portrays Milei as a leader who may prioritize personal image over accountability. In the volatile world of cryptocurrency, trust is paramount, and the public’s perception of Milei’s actions could have lasting effects on his political capital. Moreover, this event emphasizes the need for transparency and responsible governance when navigating the fragile landscape of cryptocurrencies, where the threats of fraud and mismanagement linger. Consequently, voters may become increasingly wary of politicians who engage in opportunistic promotion of such speculative assets.

Ultimately, the ramifications of this tweet deletion highlight the delicate balance between political leadership and ethical responsibility, especially in a context fraught with risks like the current cryptocurrency climate in Argentina.

DW’s Perspective: A Catalyst for Unrest

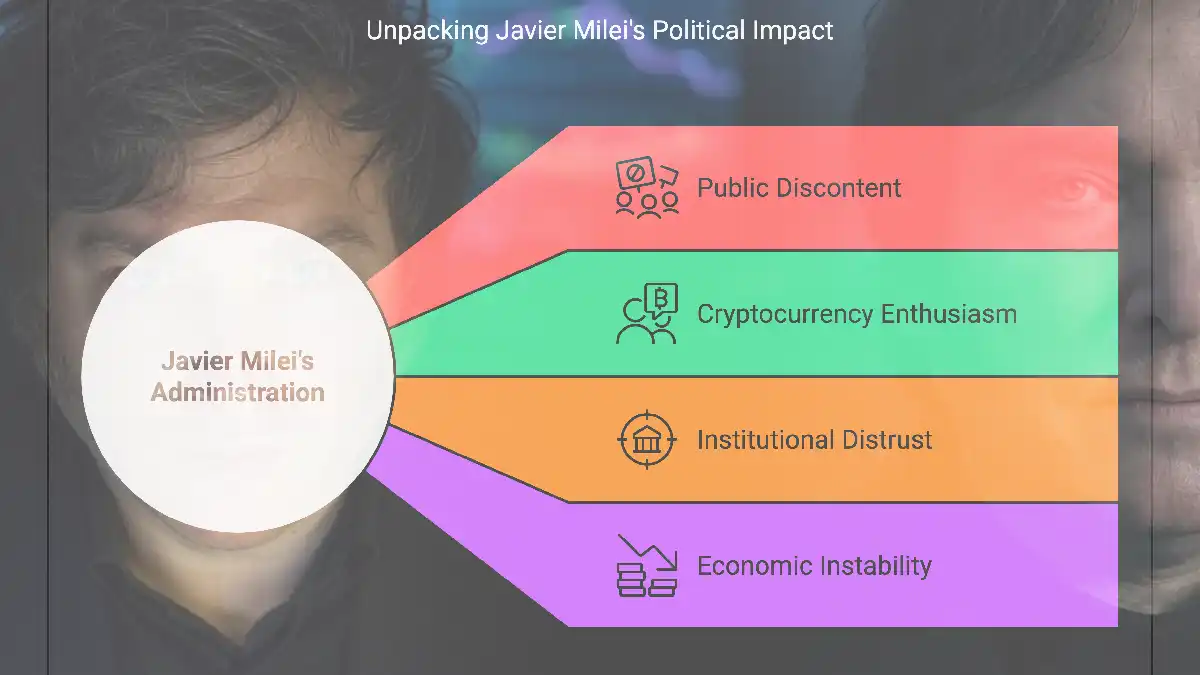

Javier Milei’s administration has undoubtedly shifted the political landscape in Argentina, primarily through his provocative social media presence. His bold statements and unconventional approach have not just made headlines, but have also contributed significantly to rising public discontent. As this discourse unfolds, the implications of such a demeanor extend beyond simple political rhetoric; they also reflect deeper issues regarding governance and public trust in leadership. The president’s engagement in debates surrounding cryptocurrency fraud, for instance, has polarized opinions across different societal demographics.

Milei’s frequent commentary on economic policy, particularly regarding cryptocurrency, has generated a level of enthusiasm among crypto investors, positioning him as a champion of digital currency. However, this enthusiasm is accompanied by skepticism, particularly in light of recent incidents involving cryptocurrency fraud and the notorious crypto collapse that has plagued investors globally. As the populace wrestles with the ramifications of Milei’s priorities, the anxiety surrounding investment safety intensifies, highlighting a lack of confidence in governmental oversight.

Furthermore, the political climate in Argentina reveals a profound distrust towards established institutions, exacerbated by Milei’s dismissive tone towards dissenters. This behavior has fostered a divisive atmosphere, where opposing views are not only invalidated but also attacked. Such conduct raises vital questions about effective governance in a country already grappling with economic instability. As economic tensions mount, public discontent is likely to manifest in protests and challenges to Milei’s authority, potentially igniting unrest. The interplay between Milei’s social media strategy and these broader themes of governance underscores the precarious nature of leadership in Argentina today.

In conclusion, DW’s perspective underscores how Javier Milei’s provocative actions serve as a catalyst for unrest, calling into question the trust the public can have in its leaders amidst rising concerns like cryptocurrency fraud and broader economic woes.

Javier Milei: The Provocateur at the Center

Javier Milei, an Argentine economist and politician, has emerged as a highly polarizing figure in the country’s political landscape. Known for his fiery rhetoric and unconventional policies, he has garnered significant attention with his endorsement of cryptocurrency as a viable alternative to traditional financial systems. Milei’s adoption of this digital currency trend has positioned him at the forefront of a broader discussion regarding the potential risks and rewards associated with emerging financial technology. This focus on cryptocurrency is particularly pertinent in light of recent economic instability and the rapid fluctuations observed in the crypto market.

Since entering the political arena, Milei has positioned himself as a libertarian advocate, presenting cryptocurrency as a solution to Argentina’s chronic inflation and economic woes. His views attract a dedicated following among those disillusioned with the conventional banking system and government interventions. However, this has also incited fierce criticism from opponents who warn that his promotion of cryptocurrencies could lead to widespread financial chaos. Detractors point to the phenomenon of cryptocurrency fraud, raising concerns over investor protections and the potential for substantial financial losses amidst a crypto collapse. These concerns illustrate the deep divisions in public opinion about the credibility and safety of cryptocurrency as an alternative investment.

Milei’s journey through this crypto calamity is characterized by a series of passionate speeches and bold claims, asserting that digital assets could revive the Argentine economy. The implications of his stance extend beyond mere financial speculation; they encapsulate the broader ideological struggle regarding state intervention in markets and the shift towards decentralized finance. As Milei continues to navigate the complex world of cryptocurrency, his future political endeavors may hinge on whether he can reconcile the aspirations of his supporters with the realities of a volatile market that invites scrutiny and skepticism.

Global Media Reactions: A Fractured Narrative

The recent foray of Javier Milei into the realm of cryptocurrency has garnered a mixed bag of reactions from international media outlets, reflecting a fractured narrative surrounding his actions and their implications. In particular, outlets like France 24 and Semafor have presented divergent perspectives on Milei’s gamble with cryptocurrencies. Some commentators herald his approach as a bold attempt to innovate Argentina’s financial landscape, advocating for greater incorporation of digital currencies in a nation grappling with economic challenges. They assert that cryptocurrency could offer a viable solution to Argentina’s ongoing inflation issues and serve as a hedge against monetary instability, thereby proposing a pathway to modernization.

Conversely, other voices in the media have criticized Milei’s embrace of cryptocurrency as reckless and ill-timed, cautioning against the inherent risks associated with such digital assets. Critics argue that the recent crypto collapse has exposed the vulnerabilities of the sector, emphasizing that the potential for cryptocurrency fraud is too significant to overlook. Highlighting the unstable nature of cryptocurrencies, these commentators warn that the volatile market could lead to further economic turmoil in Argentina, possibly deepening the financial crisis rather than alleviating it. This perspective fuels a broader debate regarding the balance between financial innovation and prudent economic management, particularly in a nation already experiencing severe fiscal distress.

The global media’s engagement with Milei’s stance on cryptocurrencies illustrates a polarization that encapsulates differing philosophies on governance and economic strategy. While some advocate for a future defined by digital currencies, others underscore the risks associated with such innovations, particularly in an environment susceptible to fraud. Ultimately, Argentina’s journey into the cryptocurrency domain serves as a pertinent case study in the complex interplay between ambition and caution in economic policymaking.

The Future of Argentina’s Financial Experiment

The current political and economic landscape in Argentina is characterized by uncertainty, particularly in light of Javier Milei’s controversial decisions surrounding cryptocurrency adoption. His advocacy for cryptocurrencies as a viable form of currency in a nation plagued by high inflation and economic instability can be seen as both an attempt to create a robust alternative financial system and a gamble with potentially perilous consequences. As Argentina grapples with the impact of economic mismanagement, the emphasis on cryptocurrencies raises questions about its implications for governance and economic reform.

Proponents of Milei’s approach argue that embracing cryptocurrency can catalyze necessary economic reforms. They suggest that, by allowing citizens to engage directly with decentralized currencies, the reliance on traditional banking systems can diminish, potentially circumventing the issues stemming from government mismanagement. However, this vision is not without its critiques. Detractors point to the risks of cryptocurrency fraud and the high volatility associated with these digital assets, emphasizing how a crypto collapse could further exacerbate Argentina’s existing financial crisis. The dangers of adapting an unregulated financial tool in an economy that struggles with governance could lead to unintended consequences.

Moreover, the transition towards a cryptocurrency-based economy poses significant governance challenges. The lack of regulatory frameworks can lead to an increase in illicit activities such as fraud, undermining the very financial stability Milei aims to achieve. In a country where the populace is already skeptical of financial institutions, a shift towards a predominantly digital currency without safeguards may reduce confidence further. Therefore, while the potential for economic reform through cryptocurrency is intriguing, the navigational hurdles must be carefully considered. The future of Argentina’s financial experiment ultimately rests on the balance between innovation and prudence in addressing its longstanding challenges.

Conclusion: Ambition Meets Controversy

In recent months, Argentina has found itself at the epicenter of a heated debate surrounding cryptocurrency and its implications for the nation’s economy. The ambitious policies introduced by Javier Milei, particularly his radical stance towards cryptocurrency, have sparked a nationwide discussion on the risks and benefits of adopting digital currencies in a country grappling with economic instability. The prospect of integrating cryptocurrencies into everyday transactions has brought forth both optimism and skepticism from various sectors of society.

The fervor surrounding the crypto market has led to an increased focus on the potential for cryptocurrency fraud, which poses a significant threat to uninformed investors. This concern is compounded by the recent experiences of other nations, where the promise of cryptocurrencies has not always translated into economic stability but rather contributed to a crypto collapse. Milei’s bold vision may attract investments, yet it simultaneously raises questions regarding regulatory frameworks and the essential safeguards needed to protect citizens from pitfalls associated with emerging financial technologies.

Examining the broader implications of Milei’s policies, one can observe that political innovation in the world of finance often dances on the knife’s edge between progress and chaos. Argentina’s situation highlights the necessity of balancing ambition with caution, as the leap towards a crypto-centric economy could have lasting effects on the populace. Amidst these discussions, it becomes clear that the underlying lesson is vital; any economic experiment must consider the complexities of human behavior and the inherent vulnerabilities that come with financial innovation. Only through careful evaluation and deliberate governance can Argentina navigate the tumultuous waters of cryptocurrency, emerging stronger and more resilient in the face of unavoidable challenges.