Introduction to Bitcoin and Its Origin

Bitcoin, introduced in 2009 by its pseudonymous creator Satoshi Nakamoto, marked a revolutionary shift in the landscape of finance and technology. This decentralized digital currency emerged against the backdrop of a global financial crisis that had caused widespread distrust in traditional banking systems. Bitcoin’s underlying principles emphasize peer-to-peer transactions devoid of intermediaries, showcasing a commitment to decentralization, privacy, and financial autonomy.

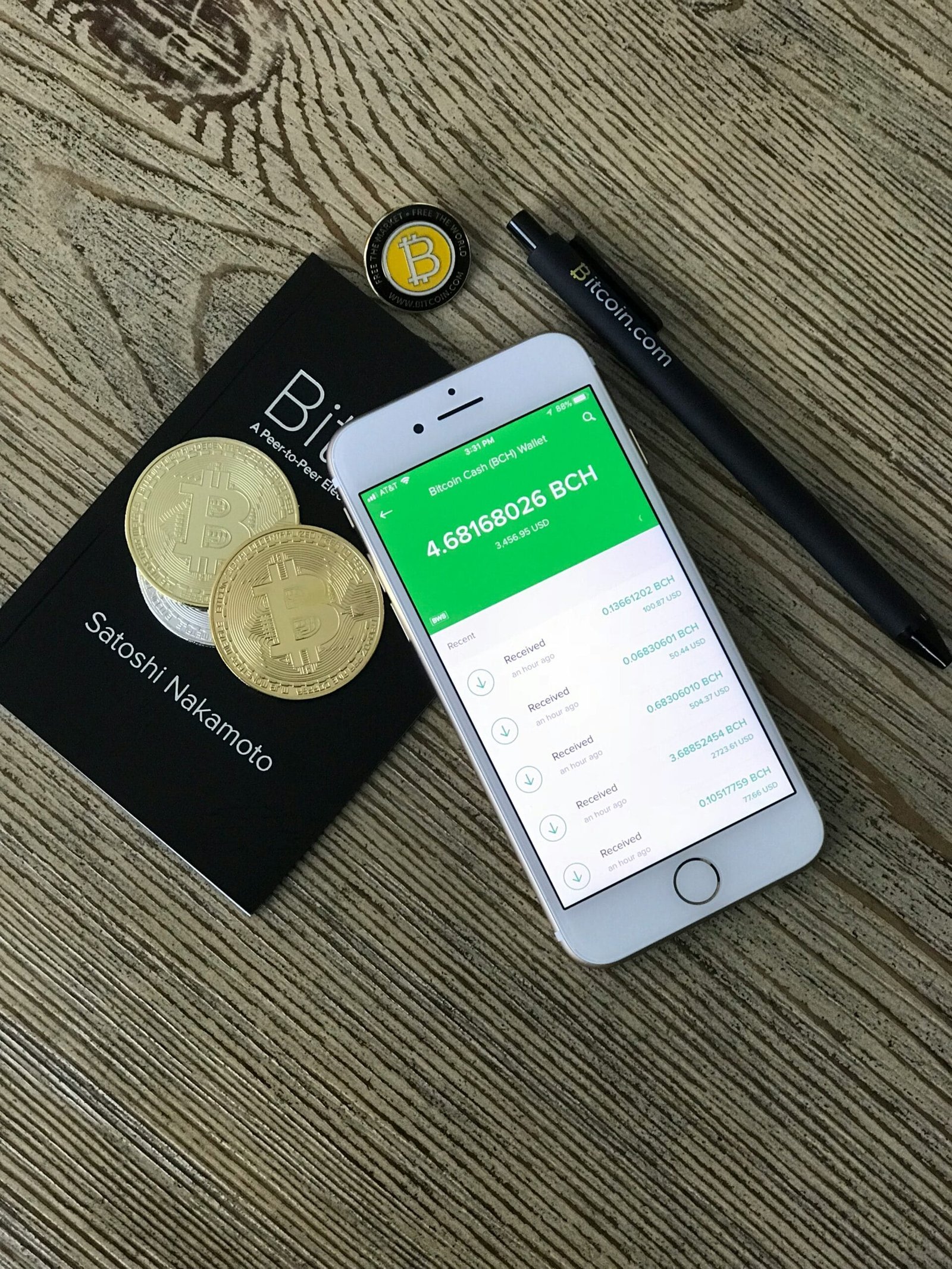

The concept of Bitcoin was articulated in Nakamoto’s whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document laid the groundwork for a system enabling users to send and receive payments directly, leveraging cryptographic techniques to secure transactions and control the creation of new units. The innovative blockchain technology enabled this, acting as a public ledger that recorded all transactions permanently and transparently, thus eliminating the need for centralized verification. This marked a significant advancement in digital currency, addressing key issues such as double-spending and security.

More informationTechnological Infrastructure and Bitcoin Adoption: Building the Future of FinanceHowever, Bitcoin faced numerous challenges during its early years, including skepticism from the public, technological barriers to mass adoption, and regulatory scrutiny. Many viewed it as a speculative asset rather than a legitimate currency. Yet it steadily gained traction among early adopters and tech enthusiasts who recognized its potential as an alternative financial system. As Bitcoin progressed, it opened the door for the development of a vibrant ecosystem of cryptocurrencies and blockchain technologies, fostering competition and innovation within the financial sector.

By proposing an alternative to fiat currency and traditional banking systems, Bitcoin aimed to empower individuals while providing a new means of value exchange. As it evolved, Bitcoin began to capture the attention of investors, technologists, and regulators alike, setting the stage for its transformation from a niche technology to a more widespread global currency.

Understanding Innovation Adoption and the Chasm

The concept of innovation adoption plays a critical role in understanding how new technologies diffuse through society. It encompasses a variety of stages that individuals and organizations go through as they come to embrace a novel product or service. The technology adoption lifecycle is often depicted as an S-curve, divided into key segments: innovators, early adopters, early majority, late majority, and laggards. Each group exhibits distinct characteristics, thereby influencing the overall adoption trajectory.

More informationFrom Cypherpunks to $80k: The Ideological Victory of BitcoinAt the inception of this curve, innovators are the first to venture into adopting new technology. They are typically characterized by a high tolerance for risk and a willingness to experiment with pioneering innovations. Following them are the early adopters, who play a crucial role in validating the technology and often possess a strong degree of influence in their communities. Despite this positive momentum, a significant challenge must be faced: the ‘chasm’ which lies between the early adopters and the early majority.

The chasm represents a critical transition point where the technology’s early proponents must convince a broader audience of its utility and relevance. If the technology fails to cross this divide, it may remain a niche product rather than evolving into a mainstream solution. In the context of Bitcoin, the journey from obscurity to widespread acceptance encapsulates this phenomenon. Initially adopted by enthusiasts and those curious about its potential, Bitcoin experienced considerable hurdles before gaining significant traction in broader markets.

Thus, understanding these dynamics is essential to grasp the broader implications of Bitcoin’s rise as a global currency. By studying the stages of the adoption curve and recognizing the importance of crossing the chasm, one can appreciate the strategic challenges technology faces as it transitions from a niche application to a mainstream monetary solution. This framework is pivotal in elucidating Bitcoin’s complexities and its ongoing journey toward widespread adoption.

More informationFrom Pizza to $80K: Bitcoin’s Greatest Cultural MomentsBitcoin’s Early Adopters: Who Were They?

Bitcoin’s emergence as a revolutionary digital currency in 2009 attracted a diverse group of early adopters, each motivated by distinct ideologies and aspirations. Among the most significant were technophiles—individuals deeply passionate about technology and its potential to disrupt traditional systems. These early enthusiasts recognized Bitcoin’s underlying blockchain technology as a groundbreaking innovation, offering the promise of decentralization and security. They eagerly experimented with the currency, testing its functionalities and advocating for its broader adoption, further fueling interest in the burgeoning ecosystem.

Another prominent segment of early adopters comprised libertarians, who regarded Bitcoin as a means to promote personal freedom and financial autonomy. This ideological commitment to minimal government intervention resonated with the tenets of Bitcoin’s creator, Satoshi Nakamoto, whose vision encompassed eliminating the need for central banks. For libertarians, Bitcoin represented not just an investment opportunity but a vehicle for challenging the traditional monetary system and fostering individual empowerment.

Additionally, individuals seeking financial privacy were drawn to Bitcoin’s pseudonymous nature. In a world increasingly governed by surveillance and data-sharing practices, these individuals valued the discretion that Bitcoin offered. Their motivations were often rooted in concerns about their financial privacy and the desire to protect their wealth from potential inflation or confiscation by authoritarian regimes.

More informationDonald Trump’s Social Media Group in Talks to Acquire Crypto Trading Platform BakktNoteworthy early adopters included prominent figures like Hal Finney, a computer scientist and one of the first to engage with Bitcoin, and companies such as WordPress, which began accepting the cryptocurrency as payment. Their enthusiasm and commitment played a crucial role in laying the groundwork for Bitcoin’s global acceptance. Through a combination of technological innovation, ideological beliefs, and privacy concerns, these early adopters significantly shaped the trajectory of Bitcoin, contributing to its evolution from a niche technology to a recognized global currency.

Challenges on the Path to Mainstream Adoption

Bitcoin’s transition from a niche technology to a widely accepted global currency has been fraught with numerous challenges that have significantly impacted its adoption rate. One of the foremost hurdles encountered has been regulatory scrutiny. Governments worldwide grappled with how to classify Bitcoin, leading to varied regulations that can create uncertainty for users and investors. In some regions, outright bans were implemented, while others adopted a cautious approach, establishing frameworks that promote innovation but protect consumers. This disparity in regulation not only hampered Bitcoin’s acceptance but also contributed to a convoluted legal landscape.

Another major challenge lies in scalability issues. The Bitcoin network has experienced difficulty accommodating an ever-increasing transaction volume, resulting in slower processing times and higher transaction fees. As Bitcoin gained traction, the limited block size of the blockchain became a significant bottleneck, raising concerns about its capacity to serve as a global payment solution. These scalability problems have prompted discussions about potential technological advancements and solutions like the Lightning Network, yet the persistent debate reveals an underlying tension within the community regarding the direction of Bitcoin’s development.

More informationThe Future of Bitcoin: Will It Replace Traditional Currencies?Security concerns have further complicated Bitcoin’s pathway to mainstream acceptance. High-profile hacks, exchange breaches, and fraudulent schemes have undermined public trust in Bitcoin. Incidents such as the Mt. Gox hack in 2014, where approximately 850,000 Bitcoins were stolen, resulted in considerable skepticism about the cryptocurrency’s reliability. Media portrayal of these events often accentuated the negative, fixating on tales of lost investments rather than the underlying technology’s potential. Consequently, the perception of Bitcoin as a risky asset has persisted, challenging its reputation as a stable and viable currency option.

Key Innovations That Facilitated Growth

Bitcoin has undergone significant evolution since its inception, driven by a series of technological innovations that have substantially enhanced its utility, scalability, and security. The most prominent among these is the Lightning Network, a second-layer solution designed to facilitate faster transactions with lower fees. By enabling off-chain transactions, the Lightning Network alleviates congestion on the Bitcoin blockchain, allowing users to conduct instant transactions without waiting for block confirmations. This advancement has directly addressed one of the primary concerns regarding Bitcoin—a sluggish transaction speed during peak periods—thus making it more appealing for everyday use.

In addition to scalability improvements, security enhancements have also contributed to Bitcoin’s growth. Over the years, the Bitcoin protocol has undergone numerous upgrades that bolster its resistance to hacking and other security threats. Innovations such as Segregated Witness (SegWit), while primarily aimed at enhancing capacity, also improve security by allowing signatures to be stored separately from transaction data. These improvements have instilled greater confidence among both individual users and businesses, creating an environment where Bitcoin can be utilized more safely and effectively.

More informationBitcoin vs Fiat Currency: Pros and ConsFurthermore, the emergence of user-friendly wallets has played a crucial role in Bitcoin’s expansion into the mainstream. The introduction of various wallet applications, which incorporate features such as intuitive user interfaces and simplified key management, has effectively lowered the barrier to entry for new users. These wallets make it straightforward for individuals—not just tech-savvy enthusiasts—to buy, store, and spend Bitcoin. As a result, this has broadened the demographic of users who can engage with Bitcoin, ultimately supporting its journey from a niche technology to a recognized global currency.

Bitcoin’s Role in the Financial Freedom Movement

Bitcoin has emerged as a significant force in the financial freedom movement, offering individuals an alternative to traditional banking systems. In regions affected by unstable currencies, hyperinflation, or authoritarian regimes, the decentralized nature of Bitcoin provides a viable solution for those seeking autonomy over their financial resources. The inception of Bitcoin was largely driven by a desire to create a peer-to-peer electronic cash system, devoid of government control and intervention.

One of the most illustrative examples can be found in Venezuela, where hyperinflation has rendered the national currency virtually worthless. Citizens have turned to Bitcoin as a means to protect their savings and conduct transactions, often using digital wallets to facilitate trade without reliance on a vulnerable banking infrastructure. This transition illustrates how Bitcoin empowers individuals to reclaim their financial agency despite external economic pressures.

Similarly, in countries with authoritarian regimes, such as Belarus or Turkey, Bitcoin allows individuals to circumvent restrictions imposed on their financial activities. Protesters in these regions have adopted Bitcoin to fund activism and express dissent. This use of cryptocurrency demonstrates its potential to facilitate financial freedom in oppressive environments, enabling individuals to safeguard their wealth and promote social change.

The rise of Bitcoin has prompted discussions around the potentials of cryptocurrency in bolstering financial independence globally. The ability to transact, save, and store value without intermediaries resonates deeply with those marginalized by traditional financial systems. As Bitcoin continues to gain traction, it serves as an alternative form of financial security, offering hope to those who have long been disenfranchised and empowering them to take control of their financial destinies.

The Impact of Institutional Adoption

In recent years, the landscape of Bitcoin has undergone a significant transformation, primarily driven by the increasing acceptance and adoption of this digital currency by institutional investors and large corporations. This trend marks a pivotal shift from Bitcoin being perceived merely as a speculative asset to a legitimate component of investment portfolios. Noteworthy milestones, such as Tesla’s announcement of a substantial investment in Bitcoin and Square’s commitment to facilitating Bitcoin transactions, have underscored this change. These public endorsements from influential organizations have not only enhanced the credibility of Bitcoin but have also encouraged other institutions to evaluate their stances regarding digital currencies.

The implications of institutional adoption extend beyond mere endorsement; they reflect a growing acknowledgment of Bitcoin as a viable store of value comparable to traditional assets. As institutions incorporate Bitcoin into their strategies, they contribute to an expanded market infrastructure, which bolsters liquidity and diminishes volatility. This transition is evident through the rise of regulated financial products linked to Bitcoin, including exchange-traded funds (ETFs). The approval of Bitcoin ETFs in various jurisdictions has provided retail investors access to Bitcoin markets through familiar vehicles, further accelerating the trend of mainstream acceptance.

Moreover, the involvement of institutional players signifies a shift in the perception of Bitcoin’s long-term viability. Investments made by hedge funds and pension funds showcase a commitment to integrating Bitcoin as part of a diversified investment strategy. This legitimization not only enhances Bitcoin’s profile as a digital asset but also catalyzes broader adoption among the general populace as confidence grows. The increased regulatory scrutiny that often accompanies institutional investment is also likely to result in an improved framework for Bitcoin transactions, addressing long-standing concerns regarding security and market integrity.

Current Status and Global Acceptance of Bitcoin

As of October 2023, Bitcoin’s status in the global financial landscape continues to evolve significantly. Once regarded primarily as a niche technology for tech enthusiasts and libertarians, Bitcoin has gradually gained acceptance across various sectors and regions around the world. Governments, financial institutions, and individual investors are increasingly recognizing the potential of Bitcoin as a viable currency and store of value.

In multiple regions, Bitcoin is being embraced as a legitimate medium of exchange. Latin America has seen notable adoption, particularly in countries with economic instability, where citizens have turned to Bitcoin to mitigate inflation and preserve wealth. Nations like El Salvador have even made Bitcoin legal tender, encouraging businesses and consumers to engage with cryptocurrency. Furthermore, several European countries are establishing regulatory frameworks aimed at integrating Bitcoin into the mainstream financial system while ensuring consumer protection and anti-money laundering compliance.

Infrastructure supporting Bitcoin transactions is also expanding markedly. A growing number of merchants now accept Bitcoin as a payment method, with payment processors facilitating seamless cryptocurrency transactions. Additionally, the number of ATMs providing Bitcoin access has surged globally, enhancing user accessibility and convenience. Investment vehicles such as Bitcoin-focused funds and exchange-traded products have further legitimized Bitcoin in traditional financial markets.

The cryptocurrency market is characterized by volatility, yet public sentiment towards Bitcoin appears to be shifting positively. Numerous surveys reveal an increasing willingness among the general public to consider Bitcoin as a potential investment or alternative asset class. This trend is fueled by increasing media coverage, the participation of institutional investors, and ongoing discussions surrounding digital currencies. Overall, Bitcoin is cementing its position as a global currency, reflective of a broader trend towards the acceptance of cryptocurrencies in everyday transactions and as an investment opportunity.

Future Prospects: What Lies Ahead for Bitcoin?

Bitcoin, initially conceived as a decentralized digital currency, has undergone significant transformations since its inception. As advancements in technology persist, the future of Bitcoin appears promising yet complex. Key factors influencing its trajectory include enhancements in blockchain technology, evolving regulatory frameworks, and shifting market dynamics. Central to these developments is the ongoing debate regarding Bitcoin’s classification as either a global currency or a speculative asset.

Advancements in blockchain technology are paramount for Bitcoin’s future. Innovations such as the Lightning Network aim to improve transaction speed and scalability, addressing longstanding criticisms regarding Bitcoin’s ability to handle large volumes of transactions. Furthermore, efforts to enhance security and privacy features on the blockchain could bolster user confidence and drive wider adoption. These technological innovations may effectively transform Bitcoin from a niche asset to a more mainstream financial tool.

The regulatory landscape is equally influential. Governments across the globe are increasingly scrutinizing cryptocurrencies, with varied responses that range from outright bans to supportive frameworks. The establishment of comprehensive regulations could foster legitimacy and stability, encouraging institutional investment. Conversely, overly stringent regulations could stifle innovation and alienate investors, highlighting the delicate balance required in regulation. How national and international regulators respond will significantly impact Bitcoin’s role in global finance.

Market trends also play a crucial role in shaping Bitcoin’s future. As mainstream adoption increases, driven by corporate investments and interest from institutional investors, Bitcoin’s volatility may gradually decrease. However, it remains to be seen whether Bitcoin will solidify its position as a global currency or remain predominantly a speculative asset driven by market sentiment. The future of Bitcoin will undoubtedly hinge on the synergy of technological advancements, regulatory clarity, and evolving market perceptions.