Introduction to Bitcoin and Its Rise

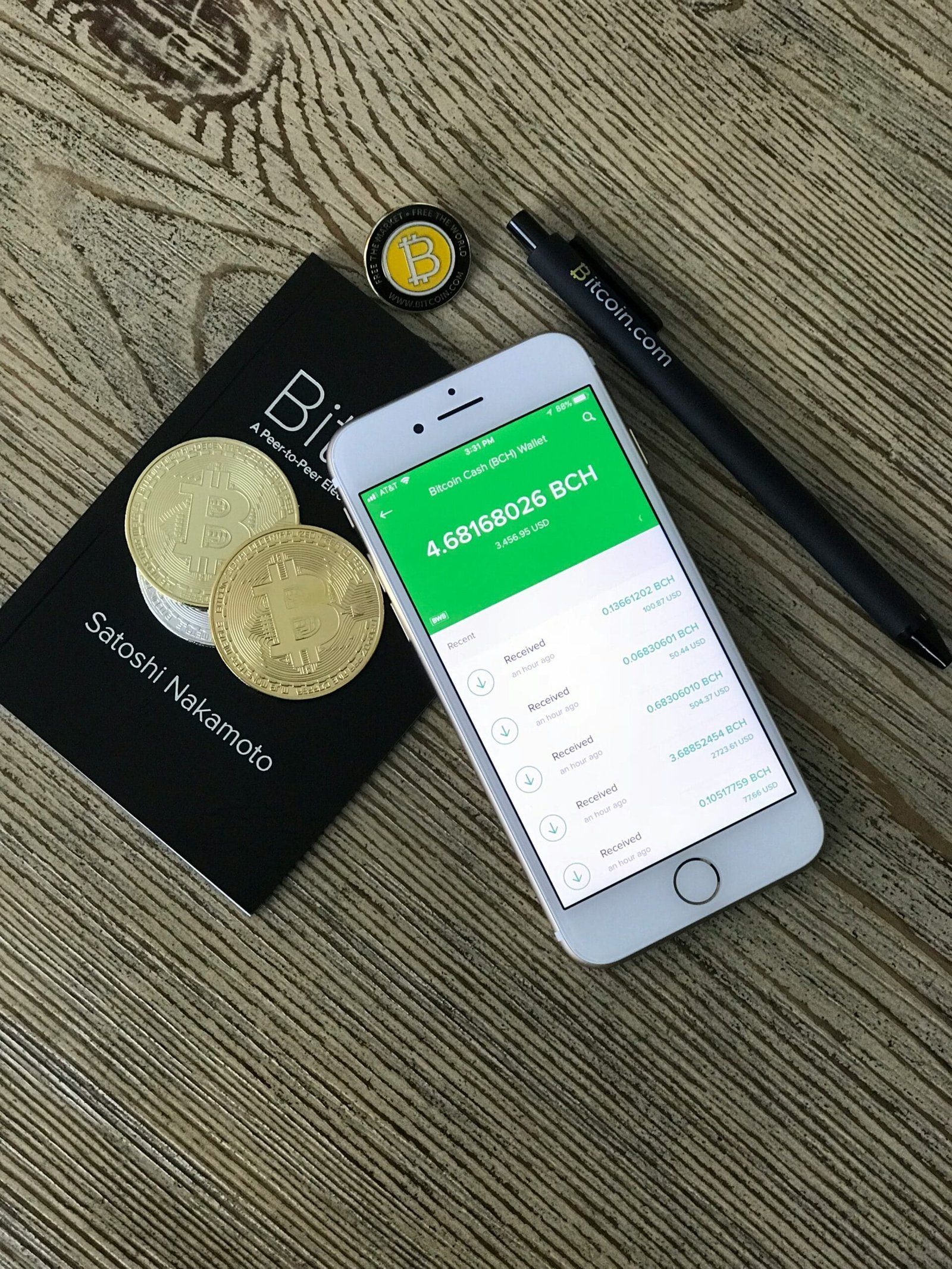

Bitcoin, the pioneering cryptocurrency, was introduced in 2009 by an individual or group operating under the pseudonym Satoshi Nakamoto. Its inception marked a significant milestone in the evolution of digital currencies, as it was designed to operate without the need for a central authority or intermediary. Bitcoin functions on a decentralized network, utilizing blockchain technology to facilitate secure and transparent transactions. This innovative approach has garnered attention from technologists, financial enthusiasts, and investors alike.

The initial years of Bitcoin’s existence were characterized by limited awareness and usage; however, several key developments sparked its widespread adoption. Initially, it gained traction among niche communities that embraced the concept of a digital currency free from government control. The first notable transaction occurred in 2010 when a programmer famously exchanged 10,000 bitcoins for two pizzas, highlighting Bitcoin’s capability as a medium of exchange. As interest grew, so did the number of merchants willing to accept Bitcoin, thus paving the way for its use in everyday transactions.

More informationHow Bitcoin Could Reshape Global BankingBy the mid-2010s, Bitcoin began capturing the attention of larger financial institutions and investors, leading to significant price appreciation and speculative investments. This rapid growth was underscored by various media reports, which propelled Bitcoin into mainstream consciousness. Additionally, the emergence of numerous alternative cryptocurrencies (altcoins) further catalyzed discussions surrounding the potential of digital currencies in reshaping traditional financial systems.

As a result of these developments, Bitcoin has solidified its status as the most recognized cryptocurrency globally. Today, it is often viewed as a digital asset or store of value akin to “digital gold,” attracting a broad spectrum of participants ranging from individual investors to institutional players. The question now arises: could Bitcoin eventually replace traditional fiat currencies in the global economy? This blog explores the factors that may influence Bitcoin’s trajectory and its role in the future of finance.

Understanding Traditional Currencies

Traditional currencies, often referred to as fiat money, are government-issued monetary instruments that serve as a medium of exchange within an economy. Unlike commodity money, which has intrinsic value (e.g., gold or silver), fiat currencies derive their value primarily from the trust and confidence that individuals have in the issuing government and its economic stability. This trust is foundational to the functioning of modern economies, as it encourages consumers and businesses to accept and utilize the currency in trade and investment.

More informationBitcoin and Cybersecurity: Protecting Your Digital AssetsThe role of traditional currencies in the economy extends beyond mere transactional purposes. They are crucial for establishing a common measure of value, which facilitates pricing goods and services, thereby contributing to market efficiency. Furthermore, fiat money plays a vital role in the implementation of monetary policy, allowing central banks to regulate the supply of money and credit in the economy. This intervention helps stabilize the economy through mechanisms such as interest rates adjustments and controlling inflation, ensuring that the purchasing power of the currency is maintained.

Value determination of traditional currencies is influenced by several interconnected factors, including supply and demand, inflation rates, and the policies enacted by central banks. When demand for a currency rises, often due to economic growth or increased employment, its value tends to appreciate. Conversely, excessive supply of money, often as a response to economic crises, can lead to inflation, thereby diminishing purchasing power. The central banking system is pivotal in regulating these dynamics, utilizing tools such as interest rates and reserve requirements to manage currency circulation effectively.

The Mechanics of Bitcoin Transactions

Understanding how Bitcoin transactions work is essential for comprehending its potential implications for traditional currencies. At the core of Bitcoin’s functionality lies blockchain technology, a decentralized digital ledger that records all transactions across a network of computers. Each transaction consists of a series of elements including the sender’s and receiver’s addresses, the amount transferred, and a digital signature generated by the sender. This data is grouped into blocks, which are then added to a continuous chain, hence the name “blockchain.”

More informationBitcoin vs Traditional Stocks: A Comprehensive ComparisonOne of the defining features of Bitcoin transactions is the process of mining, which entails solving complex mathematical problems to validate and secure transactions. Miners, who participate in this process, are rewarded with newly minted Bitcoins, incentivizing them to continue maintaining the integrity of the network. This mining activity not only facilitates the transaction process but also contributes to Bitcoin’s decentralized nature, as no single entity controls the network. Decentralization enhances security and reduces the risk of fraud, making Bitcoin transactions considerably more trustworthy compared to traditional transaction systems.

Additional advantages of Bitcoin transactions include lower fees and faster processing times. Unlike conventional banking systems that may impose significant fees on cross-border transactions and processing delays that can last several days, Bitcoin transactions can be executed with minimal fees and typically complete within minutes. This efficiency is particularly beneficial for businesses and individuals engaging in international trade. With these characteristics, Bitcoin presents a compelling alternative to fiat currencies by streamlining the transaction process while ensuring security and transparency.

Bitcoin’s Advantages Over Traditional Currencies

Bitcoin presents several compelling advantages over traditional currencies that continue to influence its growing popularity. One of the most significant aspects of Bitcoin is its decentralized nature. Unlike traditional currencies, which are regulated by central banks and governments, Bitcoin operates on a peer-to-peer network. This decentralization not only eliminates the need for intermediaries but also reduces the risk of government interference, thereby promoting a system where users can transact freely and securely.

More informationBitcoin vs Altcoins: Understanding the Key DifferencesInflation resistance is another critical advantage of Bitcoin. While traditional currencies can be subject to inflation due to increases in the money supply, Bitcoin has a capped supply of 21 million coins. This finite availability instills confidence among users as it protects against currency devaluation over time. Consequently, many individuals view Bitcoin as a digital store of value, akin to gold, safeguarding their wealth from inflationary pressures.

Digital ownership is also a defining feature of Bitcoin. Owning Bitcoin means possessing a unique digital asset that cannot be easily duplicated, ensuring true ownership and provenance. This contrasts starkly with traditional banking systems where transactions can be reversed or where individuals do not have full control of their funds. Furthermore, Bitcoin transactions provide enhanced privacy. Users can transact without disclosing their identities, offering an aspect of confidentiality that is challenging to achieve with fiat currencies, which often require personal information during transactions.

Another notable advantage is the ability to conduct borderless transactions. Bitcoin allows for instant transfers across the globe without the need for currency conversions or adherence to traditional banking hours. This feature is particularly advantageous for those who engage in international commerce or have family overseas. As more retailers and investors recognize these benefits, the acceptance of Bitcoin continues to grow, highlighting its potential to redefine the future landscape of currency.

More informationBitcoin vs Fiat Currency: Pros and ConsChallenges and Limitations of Bitcoin Adoption

Despite its potential as a replacement for traditional currencies, Bitcoin faces several significant challenges that hinder widespread adoption. One of the primary hurdles is regulatory uncertainty. Governments around the world grapple with establishing a framework for cryptocurrencies, including Bitcoin, which has led to a patchwork of regulations that vary significantly by jurisdiction. This lack of a unified regulatory approach creates confusion and may deter businesses and individuals from fully embracing Bitcoin for transactions.

Market volatility is another critical concern for those considering Bitcoin as a viable currency. The value of Bitcoin can fluctuate dramatically over short periods, making it difficult for consumers and businesses to use it as a stable medium of exchange. Such volatility undermines confidence in its ability to function as a reliable currency, as individuals may be hesitant to accept or spend Bitcoin if its value can change so drastically overnight.

Scalability is also a prominent issue affecting Bitcoin. The network’s ability to process transactions is currently limited, and as demand increases, transaction speeds can slow down significantly, leading to delays and higher transaction fees. This scalability challenge must be addressed to ensure Bitcoin can handle the volume of transactions necessary for widespread use as a substitute for traditional currencies.

More informationCrossing the Chasm: Bitcoin’s Journey from Niche Technology to Global CurrencyPublic perception plays a crucial role in Bitcoin’s adoption as well. Many people remain skeptical of cryptocurrencies, associating them with illicit activity or viewing them as speculative investments rather than genuine currency options. Furthermore, security concerns and the susceptibility of Bitcoin exchanges to hacking incidents exacerbate these issues, as users may fear losing their investments. Educating the public about Bitcoin’s benefits and addressing these security challenges will be essential in overcoming the limitations to its adoption.

Economic Implications of Widespread Bitcoin Adoption

The potential widespread adoption of Bitcoin presents considerable economic implications that could transform the financial landscape. One of the significant impacts would be on monetary policy. Central banks traditionally control monetary supply and influence economic activity through interest rates. However, with Bitcoin’s decentralized nature, central banks could face challenges in regulating the economy. If Bitcoin becomes a mainstream currency, it may limit the effectiveness of traditional monetary policy tools, as individuals could choose to store value in Bitcoin rather than in their national currency. This shift could lead to increased volatility in fiat currencies as confidence in central banking systems could weaken.

In addition to monetary policy, the banking sector may undergo substantial transformation. Traditional banks serve as intermediaries for transactions, custody, and lending; however, the adoption of Bitcoin could disrupt this intermediary role. Peer-to-peer transactions enabled by Bitcoin’s blockchain technology allow users to transfer value directly without needing a bank. Consequently, banks may have to adapt their business models, potentially leading to reduced profitability and a re-evaluation of their roles in the financial ecosystem.

International trade could also experience notable changes. Bitcoin’s accessibility, lower transaction fees, and ability to facilitate cross-border transactions without the need for currency conversion can enhance trade efficiency. As companies and individuals increasingly seek to conduct business in Bitcoin, the reliance on traditional banking infrastructures may decline. This shift may result in a more interconnected global economy where cross-border transactions become simpler and faster, ultimately fostering economic growth.

Overall, the widespread adoption of Bitcoin could lead to profound changes in the monetary system, banking operations, and international commerce. As the dynamics of financial interactions evolve, stakeholders must navigate this emerging landscape proactively to harness the opportunities and mitigate the risks associated with Bitcoin’s integration into everyday transactions.

Regulatory Perspectives on Bitcoin

The regulatory environment surrounding Bitcoin and other cryptocurrencies is complex and continually evolving. Different countries have adopted various approaches regarding the treatment and governance of Bitcoin, leading to a diverse landscape that significantly impacts its acceptance and integration into the mainstream financial system. In jurisdictions like the United States, the regulatory framework is fragmented, with multiple agencies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), playing a role in overseeing cryptocurrency activities. This multi-agency approach has led to uncertainty for investors and businesses alike, as it remains unclear which agency has primary jurisdiction over certain aspects of Bitcoin.

Conversely, countries like El Salvador have embraced Bitcoin as legal tender, showcasing a more progressive stance toward cryptocurrency adoption. By integrating Bitcoin into the national economy, El Salvador aims to enhance financial inclusion and reduce transaction costs for remittances. However, such moves raise questions regarding long-term stability and regulatory safeguards, as the volatility of Bitcoin can pose risks to economic systems heavily dependent on it.

Regulation plays a crucial role in establishing stability in the cryptocurrency market. Many industry experts argue that clear regulatory guidelines are essential for fostering innovation while simultaneously protecting consumers from potential fraud and market manipulation. Potential frameworks may include comprehensive measures aimed at Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, which are increasingly becoming the standard in various jurisdictions. Striking a balance between encouraging technological advancement in blockchain and ensuring consumer safety remains a significant challenge for regulators worldwide.

The future of Bitcoin may heavily depend on how effectively governments can adapt their regulatory approaches to this burgeoning asset class. By fostering transparency and clarity, regulatory authorities could enable the responsible growth of Bitcoin within traditional financial systems, ultimately determining its role as a potential replacement for traditional currencies.

Case Studies: Bitcoin in Action

Bitcoin has increasingly been adopted in various markets, showcasing its potential as a valid alternative to traditional currencies. One notable case is El Salvador, which became the first country to accept Bitcoin as legal tender in September 2021. The government aimed to increase financial inclusion and attract foreign investment through this innovative monetary policy. However, the initiative has faced challenges, including significant fluctuations in Bitcoin’s value, which raised concerns among citizens regarding its stability as a medium of exchange. Despite these challenges, Bitcoin continues to be utilized in numerous transactions for goods and services, demonstrating its unique position in the financial ecosystem.

Another example is the rise of Bitcoin transactions in countries experiencing hyperinflation, such as Venezuela. In this context, citizens have turned to Bitcoin as a more stable store of value compared to the national currency. Local businesses have started accepting Bitcoin to facilitate trade and mitigate risks associated with currency devaluation. This trend indicates a shift toward alternative economies that challenge conventional fiat systems, but it is also fraught with risks, particularly due to legislative uncertainties.

Moreover, several prominent companies in the tech and retail sectors have embraced Bitcoin payments. For instance, Tesla announced in early 2021 that it would accept Bitcoin for vehicle purchases. This decision signaled strong corporate confidence in Bitcoin’s long-term viability, generating considerable media coverage and spurring further interest. However, Tesla’s subsequent suspension of Bitcoin payments due to environmental concerns surrounding Bitcoin mining highlighted the ongoing debates about sustainability in the cryptocurrency landscape.

Through these case studies, it is evident that Bitcoin’s integration into various economies is a multifaceted phenomenon, marked by both achievements and hurdles. The evolving nature of Bitcoin transactions provides valuable insights into its potential to reshape financial systems worldwide.

Future Predictions for Bitcoin

The future of Bitcoin remains a focal topic among economists, investors, and cryptocurrency enthusiasts alike. Numerous experts have offered various predictions about Bitcoin’s trajectory, highlighting its potential to evolve beyond a speculative asset. As an innovative digital currency, Bitcoin is being considered for its capabilities to operate alongside traditional financial systems or, in the long run, even replace them. Analysts have suggested that Bitcoin may reach a critical tipping point that could significantly boost its adoption among the general public and institutional investors.

Market analyses indicate that as regulatory frameworks and acceptance of digital currencies evolve, Bitcoin could solidify its position in the financial ecosystem. For example, several countries are beginning to implement regulations that support the use of cryptocurrencies, making transactions more seamless and secure. This shift could promote broader acceptance and trust in Bitcoin as a viable medium for exchange. Notably, developments in technology, including enhancements in transaction speed and scalability, are likely to position Bitcoin more favorably compared to traditional currencies.

Furthermore, scenarios have been proposed regarding the coexistence of Bitcoin with fiat currencies. It is anticipated that in some cases, Bitcoin may serve as a complementary asset rather than a complete replacement. Factors such as economic instability and inflation in various regions could also propel individuals and businesses to adopt Bitcoin as a hedge against traditional currency volatility. Consequently, the narrative surrounding Bitcoin’s future remains fluid, relying heavily on independent market forces and regulatory changes. As we move forward, the potential for Bitcoin to either coexist with or supersede established currencies will continue to be a critical area of examination.

Conclusion: The Path Ahead for Bitcoin and Currencies

The discourse surrounding Bitcoin and its potential to replace traditional currencies has garnered significant attention in recent years. As we evaluate the prospects of Bitcoin in this context, it is crucial to consider both its advantages and the challenges it faces. The decentralized nature of Bitcoin offers a novel approach to monetary transactions, eliminating intermediaries and potentially lowering transaction costs. Furthermore, its global accessibility presents opportunities for those in underbanked regions, making a case for greater financial inclusion. The transparency provided by blockchain technology enhances trust, which traditional fiat systems struggle to achieve due to inherent complexities and bureaucratic processes.

However, despite these merits, several hurdles remain for Bitcoin to transition fully into a mainstream currency. Regulatory obstacles persist, with governments worldwide grappling with how to integrate cryptocurrencies into existing financial frameworks. The volatility of Bitcoin’s value poses a significant barrier to its use as a reliable means of exchange, limiting its acceptance for everyday transactions. Additionally, the debate surrounding environmental sustainability and the energy consumption associated with Bitcoin mining can hinder its widespread adoption, particularly in an era increasingly focused on climate change mitigation.

Another factor to consider is the evolving nature of financial technology itself. As central banks explore the creation of Central Bank Digital Currencies (CBDCs), the competition between these state-backed digital currencies and Bitcoin may reshape the financial landscape. While Bitcoin advocates posit that it can coexist with traditional currencies, the future dynamics will depend heavily on regulatory responses, market behaviors, and societal acceptance.

In conclusion, the potential for Bitcoin to replace traditional currencies remains an open question characterized by both promising advantages and significant challenges. Stakeholders in the financial ecosystem must weigh these factors carefully to navigate the complexities of this rapidly evolving landscape. Embracing these changes may lead to a more inclusive financial system, though the path ahead requires foresight and adaptability from all involved parties.

- Trump Panama Canal Target, Panama President Response, More

- Bloomberg Daybreak Asia: Honda-Nissan Merger Looms (Podcast)

- Honda and Nissan Aim to Finalize Merger Pact in June, NHK Says

- Trump Panama Canal Threats, Mayorkas on Deportations, More

- Malaysia Air Grounds New Airbus Days After First Flight, BT Says