Introduction to Taxation

Taxation serves as a fundamental component of modern economies, established over centuries to support the functioning of governments and the provision of essential services. Historical records trace the origins of taxation back to ancient civilizations, where rulers imposed levies on their subjects not only to fund military endeavors but also to maintain infrastructure and public welfare. The evolution of taxation has since mirrored societal changes, reflecting shifts in governance, economic structures, and philosophical views regarding the role of the state.

Primarily, taxation is framed as a mechanism for funding public goods and services, such as education, healthcare, infrastructure, and security. These services contribute significantly to the overall well-being and functionality of society, thus nurturing a sense of communal responsibility among citizens. The revenue generated through taxation enables governments to redistribute wealth, invest in social programs, and promote economic stability. However, as the role of taxation has expanded, so too have the discussions surrounding its ethical implications.

More information How to Buy Bitcoin Securely in 2024: A Comprehensive Guide

How to Buy Bitcoin Securely in 2024: A Comprehensive GuideOne of the critical debates centers on whether taxation represents an ethical obligation for citizens. Proponents argue that taxes are necessary for the preservation of social order and the equitable distribution of resources, positing that citizens have a moral duty to support communal facilities that benefit all. Critics, on the other hand, question the coercive nature of taxation, contending that the mandatory collection of taxes undermines personal autonomy and infringes upon individual rights. This tension raises essential questions: To what extent should individuals be compelled to contribute to the collective? Is it justifiable for governments to enact penalties for non-compliance? As society continues to grapple with these questions, the discourse around taxation remains paramount, demanding a critical evaluation of its ethical dimensions and broader implications.

The Concept of Coercive Taxation

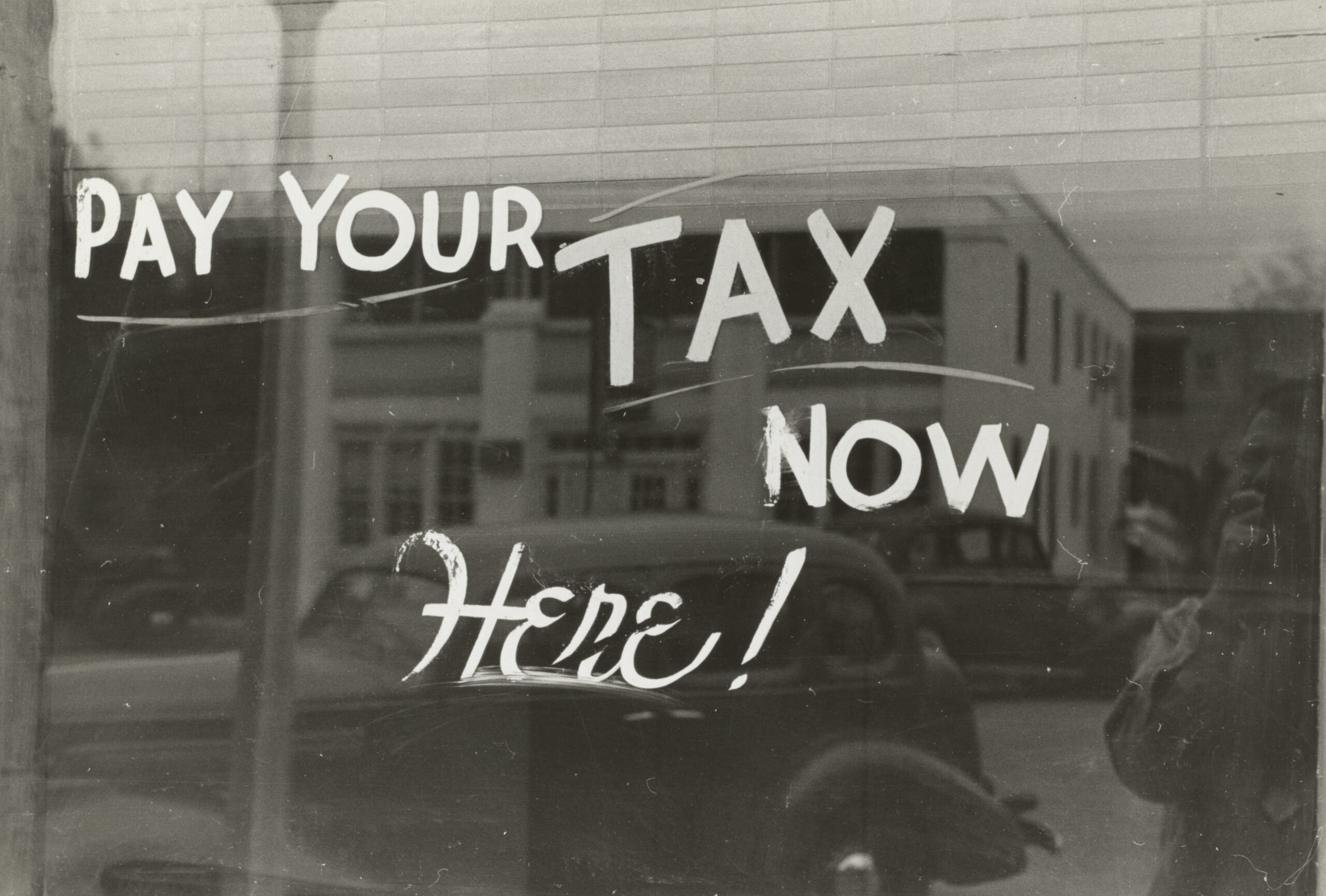

Coercive taxation is a fundamental aspect of modern government finance systems, distinguishing itself notably from voluntary funding models. In coercive taxation, the state mandates individuals and businesses to pay a specified percentage of their income or profits, which is then allocated to public services and goods. This mandatory aspect underscores the involuntary nature of tax contributions, where failure to comply can result in penalties, including fines or imprisonment. The enforcement mechanisms associated with coercive taxation highlight its divergence from voluntary funding, where contributions are made at the discretion of the individual or entity, often relying on incentives rather than compulsion.

One of the primary implications of coercive taxation is its ability to generate stable and predictable revenue for governments. This is critical for financing essential public services such as education, healthcare, and infrastructure. Unlike voluntary funding, which can fluctuate based on economic conditions or the sentiments of donors, coercive taxation ensures that the state has a reliable source of income to meet its obligations. This predictability is especially important during economic downturns when private donations might decline sharply.

More information The Journey of Bitcoin: Understanding Its History and Impact on Finance

The Journey of Bitcoin: Understanding Its History and Impact on FinanceHowever, coercive taxation raises significant ethical questions regarding individual autonomy and the fair distribution of tax burdens. Critics argue that mandatory tax contributions infringe upon personal freedoms, effectively compelling individuals to support government projects they may disagree with. Furthermore, the equitable distribution of the tax burden is a contentious issue; lower-income individuals often bear a comparatively heavier financial burden in proportional terms, sparking debates about fairness and justice within the tax system.

In contrast, voluntary funding models can foster a sense of community and individual responsibility. Supporters argue that such systems allow for greater public engagement, as donors can choose which initiatives to support. These models encourage transparency and accountability among funded entities, as they must demonstrate efficacy to attract contributions. Nonetheless, relying solely on voluntary contributions may result in unequal funding distribution, leaving essential services underfunded in less attractive areas.

Voluntary Funding vs. Taxation

Taxation is often viewed as a necessary mechanism for funding public goods and services; however, it contrasts sharply with the concept of voluntary funding. In a taxation system, citizens are obligated to contribute a portion of their income to the government, which then redistributes these funds to support various societal needs. This coercive nature of taxation typically ensures a more stable source of revenue for public projects and services. However, it may also breed resentment among those who feel their contributions are being mismanaged or inequitably used.

More information Why Does Bitcoin Have Value? An Explained Guide

Why Does Bitcoin Have Value? An Explained GuideOn the other hand, voluntary funding relies on the goodwill of individuals and organizations to financially support community projects and services. This approach can engender a stronger sense of community responsibility and engagement, as people contribute according to their own priorities and values. The voluntary funding model fosters a belief in collective responsibility, where individuals feel actively involved in societal improvement rather than merely compliant subjects of government decree. Programs funded through voluntary contributions may see greater enthusiasm and public support, driving innovation and tailoring initiatives to specific community needs.

Nevertheless, the voluntary approach also poses significant challenges, primarily due to its inconsistent and unpredictable nature. Unlike the guaranteed revenue streams from taxation, voluntary funding can result in resource gaps that hinder the sustainability of essential services and programs. This inconsistency may lead to disparities in which regions receive adequate funding and which do not, ultimately affecting the equitable provision of services such as education, healthcare, and infrastructure. Ultimately, while voluntary funding can potentially enhance community engagement and social responsibility, its effectiveness is often limited by the lack of a reliable funding mechanism that taxation provides.

Taxation as Theft: A Philosophical Perspective

The assertion that “taxation is theft” remains a contentious claim within ethical and philosophical discussions. Advocates of this viewpoint often emphasize the coercive nature of tax collection, likening it to robbery, where individuals are compelled to relinquish a portion of their earnings under threat of legal penalties. This perspective draws upon principles of individual rights and property ownership, suggesting that forcibly taking money from individuals undermines the very foundation of personal sovereignty and freedom. The implication here is that a government’s authority to impose taxes resembles that of a thief who unlawfully appropriates others’ belongings without their consent.

More information Investing and Trading: Is Bitcoin a Good Investment for Beginners?

Investing and Trading: Is Bitcoin a Good Investment for Beginners?Conversely, critiques of the “taxation is theft” narrative propose a more nuanced understanding of the role and function of taxation within a society. From this angle, taxation can be viewed as a social contract where individuals willingly contribute to the common good, thereby facilitating essential public services such as education, infrastructure, and healthcare. Proponents assert that these collective benefits justify the state’s power to levy taxes, as they ultimately promote societal well-being and economic stability. This interpretation fosters an understanding of taxation as a moral obligation rather than an act of theft, highlighting the interdependence of citizens within a functioning democracy.

Public Finance and Its Necessity

Public finance is an essential component of a well-functioning society, providing the necessary funding for various services that contribute to overall welfare and stability. At its core, public finance enables the government to collect revenue through taxation, which is subsequently allocated to essential services such as education, healthcare, infrastructure, and safety. Without a systemic approach to public finance, the provision of these fundamental services would be severely hindered, leading to a deterioration in the quality of life for citizens.

Taxation plays a pivotal role in funding public goods, which are non-excludable and non-rivalrous in nature. Examples of public goods include national defense, street lighting, and public parks. These services are vital for maintaining order and ensuring a functioning society, yet they are not typically profitable ventures for private enterprises to undertake. Consequently, reliance on taxation to fund these services becomes necessary, as this ensures equitable access for all members of society, regardless of their individual economic contributions. The collective funding model allows for a more cohesive social structure, where resources are distributed according to need rather than the ability to pay.

More information The Ethical Debate on Taxation: A Critical Analysis of Coercive Taxation

The Ethical Debate on Taxation: A Critical Analysis of Coercive TaxationHello, an additional dimension of public finance is its role in economic stabilization. During times of economic downturn, governments often adjust taxation levels to manage resources effectively and stimulate growth. This proactive approach helps to mitigate the adverse effects of recessions, demonstrating the vital importance of public finance in achieving a resilient economy. Moreover, the effective deployment of taxpayer funds towards infrastructure projects not only creates jobs but also lays the groundwork for long-term sustainable development.

Therefore, public finance, primarily through taxation, is justified as it directly supports essential services and fosters a cooperative societal environment. Its significance cannot be overstated, as it ensures the maintenance and improvement of the common good, contributing to the overall stability and prosperity of the community.

The Impact of Taxation on Individual Freedom

Taxation is often a subject of heated debate, primarily due to its direct influence on individual freedom. On one hand, taxes are necessary for funding vital public services and infrastructure; on the other hand, they can be perceived as a limitation on personal financial autonomy. Individuals may view high taxation levels as a coercive tool employed by the government, which can lead to feelings of resentment and a perceived encroachment on their freedoms.

The balance between societal needs and personal liberty becomes particularly tenuous when the tax burden increases significantly. High tax rates can reduce disposable income, thereby limiting individuals’ ability to make personal choices regarding spending and investment. The erosion of financial autonomy prompts questions about the extent to which citizens are willing to yield to state demands for funding. In turn, this could foster a disconnect between the populace and the governing structures meant to serve them.

Furthermore, individuals may begin to associate taxation with a loss of freedom rather than a civic obligation. This perception can result in negative attitudes toward the government and create a sense of alienation among citizens. Some may even argue that high taxes can lead to a culture of dependency, where individuals rely more on state provisions rather than pursuing personal endeavors. This relationship complicates the societal contract, which relies on a clear understanding that citizens contribute to the common good while enjoying certain freedoms in return.

The implications of taxation on personal freedom extend into the social dimension as well. Citizens disenchanted with perceived governmental overreach may become less engaged in civic duties or community initiatives. Encouraging active participation in the democratic process can be undermined if individuals feel that their financial contributions are coercive rather than voluntary. Overall, the challenge lies in finding a harmonious balance between generating necessary revenue for public goods while safeguarding individual freedoms and fostering a cooperative relationship between the state and its citizens.

Economic Theories Surrounding Taxation

Taxation is a pivotal element in the economic landscape, with diverse theories that shape its implementation and understanding. Classical economics, developed during the late 18th and 19th centuries, posits that taxation should primarily serve to fund essential government functions while facilitating a conducive environment for market operation. This perspective emphasizes minimal interference with market forces; thus, taxes should be instituted with fairness and efficiency in mind to avoid distortions in resource allocations.

Keynesian economics offers a contrasting view, particularly relevant in the context of economic cycles. This theory, articulated by John Maynard Keynes during the Great Depression, argues that government intervention, including strategic taxation policies, can stimulate economic activity. Keynesians advocate for progressive taxation as a tool to enhance income redistribution, which can boost aggregate demand during downturns. By adjusting tax rates according to the economic climate, governments can effectively mitigate recessions and support growth.

Modern theories of taxation, such as the theory of optimal taxation, further refine the discourse. This theory suggests that tax systems should be designed to achieve specific economic objectives while minimizing efficiency losses. It emphasizes the need for taxes to be equitable (to ensure fairness across different societal strata) and efficient (to avoid excessive burdens on economic behavior). Behavioral economics has also influenced contemporary taxation theories, exploring how taxpayers’ perceptions and responses to tax burdens affect compliance and public economic behavior.

These various economic theories reveal how taxation interacts with broader economic principles. The implications of these theories extend to policy decisions, shaping the frameworks through which governments implement tax regimes. Ultimately, understanding these theories is crucial for informed discourse on the ethics and implications of taxation, particularly as societies grapple with questions of equity, efficiency, and growth in an evolving economic landscape.

Case Studies: Countries with Varied Taxation Systems

Understanding the implications of different taxation systems can be elucidated through case studies of various countries. Countries such as Sweden and Denmark, known for their high taxation levels, have adopted progressive tax policies that fund extensive welfare programs. These nations typically report high levels of social equity, as the taxation system redistributes wealth effectively to provide essential services, including healthcare, education, and public transportation. The result is a society where citizens often express higher satisfaction with government services, perceiving these tax contributions as a necessary investment in communal welfare.

In contrast, countries like the United States and Singapore exemplify low taxation regimes that prioritize individual entrepreneurship and minimal government intervention. In these systems, public services may not be as comprehensive or readily accessible, leading to disparities in social equity. While lower taxes can stimulate economic growth by allowing individuals and businesses to retain more of their income, they may also result in underfunded public services, which can exacerbate inequalities among different social strata. Citizens in these countries may experience mixed feelings about their taxation, often viewing low tax rates as a fundamental aspect of personal freedom, while simultaneously facing challenges associated with inadequate public services.

Moreover, countries with varying taxation strategies demonstrate how these systems influence not only economic performance but also civic engagement. For instance, in nations where taxes are perceived as a means to bolster public welfare, there is often a stronger sense of community and shared responsibility among citizens. Conversely, in low-tax jurisdictions, individuals might be less inclined to participate in public discourse or advocate for shared resources, reflecting a different value system regarding governmental roles and responsibilities.

The exploration of these case studies reveals that the impacts of taxation extend far beyond the economic realm, influencing social cohesion, public trust, and overall quality of life for citizens across different nations.

Conclusion: Rethinking Taxation

Taxation has long been a fundamental aspect of governance, providing the essential funds required for public services, infrastructure, and other communal benefits. However, the ethical underpinnings and implications of taxation merit serious contemplation. Throughout this analysis, it is clear that taxation is not merely a financial tool; it embodies complex interactions between individual rights, societal needs, and governmental authority.

At the core of this discourse lies the debate over coercive funding. The perception of taxation as coercive can lead to significant discontent among taxpayers who feel that their contributions are taken without consent. This sentiment raises pertinent questions about the legitimacy of compulsory revenue generation and whether a more voluntary approach to funding public initiatives may yield better societal outcomes. Advocates of compulsory taxation argue that it ensures equitable contributions from all societal members, creating a robust platform for public finance that benefits the common good.

Moreover, the discussion around taxation demands a critical evaluation of ethical frameworks. The principles of fairness and justice are crucial in any taxation system, suggesting that taxes should be levied in a manner that reflects the ability to pay while providing for those in need. This balance remains a challenging pursuit, particularly in increasingly diverse societies where varying income levels and social inequities exist. A rethinking of how taxation is perceived and implemented could lead to innovative methods of funding public goods, potentially alleviating fears of coercion and promoting a sense of collective responsibility.

In conclusion, addressing the complexities of taxation is paramount in today’s societal landscape. Rethinking taxation requires broad discussions about the roles of government, citizenship duties, and ethical considerations. A paradigm shift towards a more transparent and participative approach to taxation could foster greater acceptance and utilization of public resources, ultimately enhancing the social contract between citizens and the state.