Introduction to Taxation

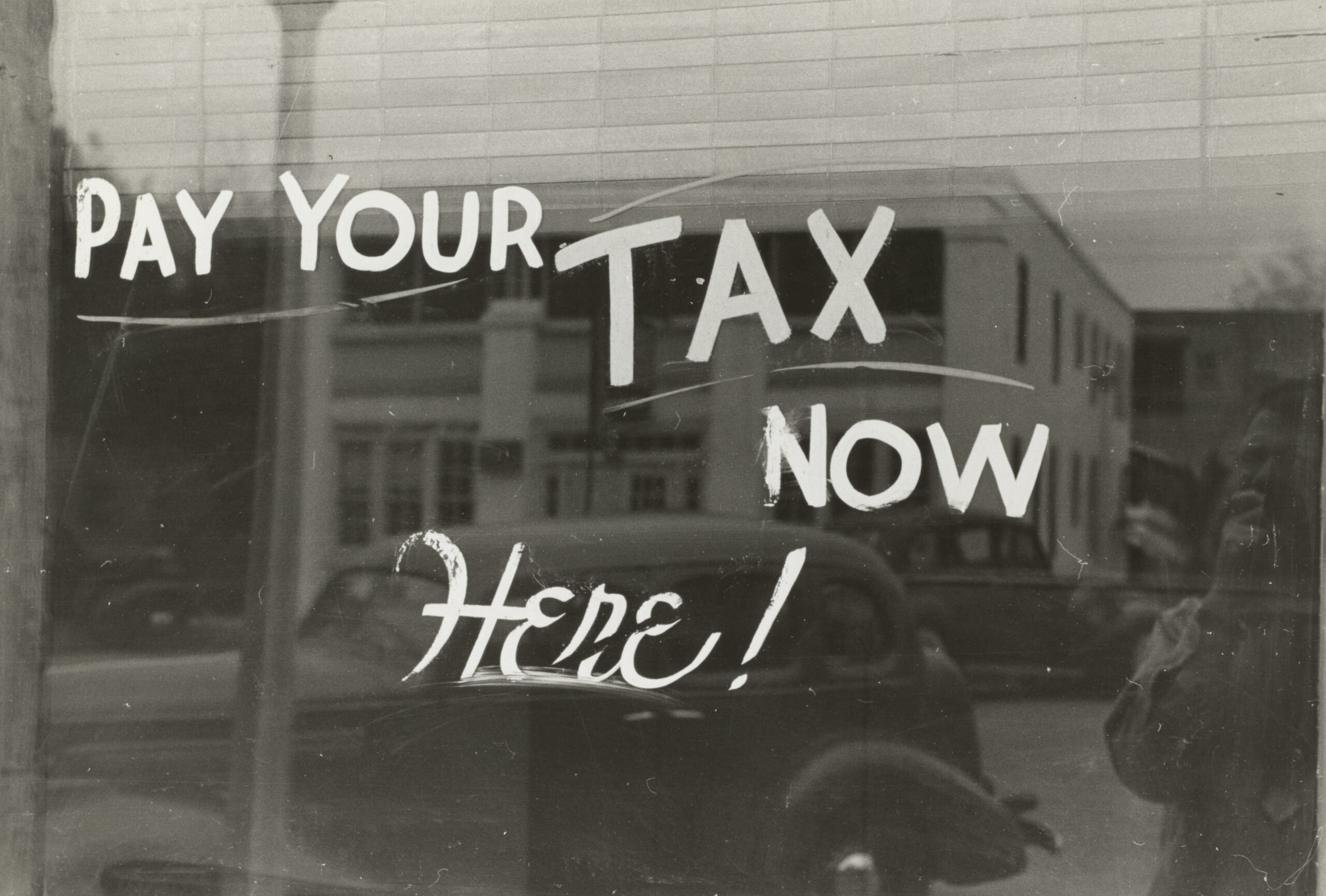

Taxation is a fundamental aspect of public finance, serving as a mechanism through which governments collect revenue to fund various services and infrastructure. It involves the compulsory financial contributions levied on individuals and businesses by a governing entity. The historical evolution of taxation can be traced back to ancient civilizations where empires imposed taxes on their subjects to fund military campaigns and public works. Over time, these practices evolved into more structured tax systems, reflecting the complexities of modern society.

Governments utilize taxation to address a range of social and economic objectives, from funding education and healthcare to regulating the economy. However, the concept of taxation often sparks debates around voluntary funding and the ethical implications of coerced contributions. Critics of the taxation system argue that it leads to a form of coercion that infringes upon individual liberties, coining the phrase “taxation is theft.” This perspective challenges the notion of government authority to demand financial support from its citizens, questioning the moral legitimacy of such actions.

The implementation of taxes raises critical questions about the balance between collective responsibility and individual rights. While many acknowledge the necessity of funding public goods and services, the coercive nature of taxation can be perceived as a violation of personal freedom. This introductory analysis sets the stage for a deeper exploration of the themes surrounding coercive taxation, examining its impact on individual autonomy and the broader implications for society. In this context, it is essential to dissect the arguments surrounding taxation, its synonyms, and its justifications while engaging with core concepts of ethical finance. Understanding these elements will contribute to a more informed discussion on the ethics of taxation and its role in contemporary society.

Understanding Voluntary Funding

Voluntary funding presents a compelling alternative to coercive taxation, inviting individuals to contribute to public finance based on their own discretion rather than under duress. This model relies on donations, crowdfunding, and other forms of voluntary contributions that support services typically funded by taxation. By appealing to personal choice, voluntary funding operates on the premise that individuals should have the autonomy to determine how and when they wish to support community projects or public services.

The essence of voluntary funding lies in its alignment with principles of freedom and personal responsibility. Unlike traditional taxation, which some argue resembles a form of theft due to its mandatory nature, voluntary funding allows individuals to engage with their communities financially in a manner that reflects their values and preferences. For example, community members may choose to contribute to local schools, parks, or healthcare facilities, fostering a sense of ownership and connection to these services. This model can encourage increased public engagement, as people are more likely to contribute to causes that resonate with their personal ideals.

However, the voluntary funding model does present challenges that merit discussion. One major concern is the potential for inconsistent or insufficient funding. Relying solely on voluntary contributions may hinder the ability of public services to operate effectively and deliver essential functions, particularly in areas that are underfunded or lack broad appeal. Additionally, disparities in wealth and willingness to contribute can result in unequal access to services, exacerbating existing social inequalities. Therefore, while voluntary funding offers a visionary alternative to coercive taxation, it is crucial to critically assess its feasibility in ensuring equitable and sustainable public finance.

The Philosophy Behind ‘Taxation is Theft’

At the heart of the debate surrounding taxation lies the contentious assertion that ‘taxation is theft’. This perspective posits that coerced taxation contradicts fundamental principles of property rights and personal freedom. Advocates argue that individuals possess an inherent right to the fruits of their labor, a concept deeply rooted in both classical liberalism and libertarian thought. Proponents of this viewpoint, including influential thinkers such as Murray Rothbard and Ayn Rand, maintain that any forced extraction of wealth from individuals constitutes a violation of their autonomy.

Critics of coercive taxation contend that it not only undermines property rights but also diminishes personal responsibility and initiative. From this viewpoint, voluntary funding mechanisms are seen as morally superior. The idea is that individuals should have the freedom to choose how their resources are allocated rather than be compelled by the state to finance its operations through coercion. Supporters of this ideology argue that when the government imposes taxes under threat of penalty, it mirrors the act of theft, where the lack of consent invalidates any claim to legitimacy.

Furthermore, this philosophical stance prompts a critical analysis of the implications of public finance. The reliance on coercive taxation raises essential questions about the legitimacy and authority of government institutions. If taxation is inherently coercive, it can be argued that such a system betrays the social contract, which ideally should be based on mutual consent and voluntary exchange. The moral ramifications of forcibly extracting funds for public goods are examined through the lens of ethical theories, which highlight the tension between communal responsibilities and individual rights. Consequently, this critique of taxation invites a re-evaluation of public finance paradigms, emphasizing the necessity for alternative funding mechanisms that respect individual autonomy while still addressing societal needs.

Public Finance and Its Necessity

Public finance plays a crucial role in the functioning of modern societies, serving as the backbone for the provision of essential services and infrastructure. It encompasses the revenue generation activities of the government, which are primarily facilitated through the collection of taxes. These funds are vital for maintaining public goods, including education, healthcare, transportation, and security. Without a structured approach to public finance, the delivery of these services would be severely impaired, potentially leading to negative societal outcomes.

Taxation is often positioned as a necessary evil, as it enables the state to fund various public initiatives that benefit the population at large. However, the discourse surrounding taxation frequently invokes the sentiment that “taxation is theft,” highlighting the coercive nature of tax collection. This perspective emphasizes the ethical dilemma inherent in mandatory tax payments, prompting critical analysis of the obligation imposed on citizens to financially support government activities. While the need for funding public goods is recognized, the broader ethical implications of coercive taxation cannot be overlooked.

The necessity of taxation can also be examined in the context of voluntary funding models. Proponents of voluntary funding argue that public goods could be financed without coercion, thereby allowing individuals to donate based on their preferences. However, the potential for underfunding and the unequal distribution of resources poses significant challenges. It is essential to recognize that public finance, through taxation, represents a collective commitment to societal welfare, albeit one that raises difficult questions about individual agency and state authority.

In scrutinizing the balance between the need for public finance and the ethics surrounding its execution, a deeper understanding of coercive taxation is required. Engaging with these themes helps to clarify the necessity of taxes in ensuring a well-functioning society while also considering the potential alternatives and their implications for equitable resource allocation.

The Dangers of Coercive Taxation

Coercive taxation, a practice often justified as a necessity for public finance, harbors several potential drawbacks that merit critical analysis. One of its most pressing dangers lies in the economic distortions it engenders. By imposing mandatory contributions from citizens, coercive systems can inadvertently disrupt market forces. For instance, when individuals are required to allocate a portion of their income to taxes, this can lead to diminished disposable income, thereby reducing consumption and stifling economic growth. Additionally, the redistribution of resources mandated by the government can often result in misallocation, where funds are steered towards inefficient or non-essential sectors, further detracting from overall economic productivity.

Moreover, the inefficiencies stemming from coercive taxation can create disincentives for hardworking individuals and businesses to excel. The notion that their efforts may be met with substantial tax liabilities undermines motivation, as individuals question the net benefits of increased productivity. This leads to a culture where the drive for innovation may be hampered, ultimately reducing societal progress. As criticisms of “taxation is theft” highlight, when individuals perceive their funding contributions as compulsory rather than voluntary, there’s a moral dilemma that questions the legitimacy of such a system.

Another critical aspect of coercive taxation is the potential for misuse of taxpayer funds, coupled with a lack of accountability in government spending. Citizens often express frustration when they perceive that their contributions are not being utilized efficiently or ethically. In many instances, funds earmarked for public goods become misappropriated or diverted to less pressing concerns, further fueling dissatisfaction among the populace. The accountability mechanisms that are supposed to regulate these systems frequently fall short, leading to a disconnect between the taxpayers and the state. Addressing these issues is paramount for restoring public trust in taxation systems and enhancing the voluntary funding mechanisms that could replace coercive measures.

Ethical Perspectives on Taxation

The ethical implications of taxation have sparked extensive debate among philosophers and economists, with perspectives varying significantly across different schools of thought. From utilitarianism to libertarianism, these frameworks offer distinct insights into the legitimacy and morality of taxation practices.

Utilitarianism, for instance, posits that actions are morally right if they promote the greatest happiness for the greatest number. From this vantage point, taxation can be justified as a means of redistributing wealth to enhance overall societal welfare. Proponents argue that voluntary funding can address societal inequalities by allocating resources toward public services essential for the populace’s well-being. However, critics within this framework highlight the coercive nature of taxation, suggesting that if taxation is perceived as theft, it undermines the very happiness it aims to promote.

Conversely, libertarianism radically opposes coercive taxation, asserting that individuals have a fundamental right to control their earnings. This perspective views any form of compulsory revenue collection as an infringement on personal freedom and property rights. Libertarians argue for minimal government intervention in economic matters, asserting that voluntary funding should be the foundation of public finance rather than enforced taxation. They contend that a society should function effectively through voluntary rather than coercive means, alleging that the coercive nature of taxation inherently conflicts with principles of justice and ethical treatment.

In addition, egalitarianism seeks to establish fairness and equality as core principles guiding taxation. Advocates emphasize the need to address disparities in wealth and opportunity, promoting taxes that can enhance social equity. They acknowledge the contentious nature of taxation but argue that a well-structured tax system can help create a more just society. However, this is often critiqued by those who believe such systems rely on coercive measures contrary to the ideals of voluntary funding and individual autonomy.

Case Studies of Taxation Systems

The examination of taxation systems worldwide reveals a spectrum of approaches, from cooperative to coercive models. Understanding these frameworks provides valuable insights into the ongoing ethical debate surrounding the significance of taxation, notably in the context of the assertion that “taxation is theft.” Various countries implement their taxation strategies differently, which directly influences public finance and the dynamics of governance.

One notable example is Denmark, renowned for its high taxation rates that support an expansive welfare state. Here, taxation is framed as a social contract, operating on the principle of voluntary funding. Citizens willingly contribute, believing that their taxes are reinvested in essential public services such as healthcare and education. Consequently, this cooperative model promotes trust in government institutions while fostering a sense of shared societal responsibility.

In stark contrast, consider the taxation systems in regions characterized by significant political instability, such as certain countries in Africa. In these areas, taxation practices often reflect coercive mechanisms, with governments relying heavily on compulsory taxation methods to extract funds from citizens. The disconnection between taxpayer contributions and public services often fosters resentment, supporting the narrative that “taxation is theft.” This perception is exacerbated by corruption and the lack of transparency, where citizens see little return on their investments into public finance.

Likewise, in the United States, the taxation system exhibits both cooperative and coercive elements. While many Americans recognize the importance of taxation for public goods, others express concerns over perceived overreach by the government. The debate often revolves around the balance between voluntary funding and coercive taxation practices, leading to significant discussions on reforming tax policy to ensure fairer contributions and equitable distribution of resources.

These diverse case studies illustrate that taxation systems are deeply influenced by cultural, political, and economic factors. They provide a platform for further examination of how various methods of public finance can operate within ethical frameworks, highlighting the importance of context in the ongoing discourse regarding taxation and its implications on society.

The Role of Public Opinion in Taxation Debates

Public opinion plays a significant role in shaping the landscape of taxation debates and policies. Various factors contribute to how individuals perceive taxation, influencing their acceptance or opposition to government practices. One major factor is the economic environment. During times of economic prosperity, citizens may be more inclined to support increasing public finance initiatives, as they may view higher taxes as a means to fund essential services and infrastructure. Conversely, in times of economic downturn, public sentiment often shifts toward a more negative perception of taxation, with a growing belief that “taxation is theft.” Such sentiments can elevate calls for voluntary funding mechanisms as alternatives to coercive taxation.

Political beliefs also significantly impact public opinion on taxation. Different political ideologies frame taxation through contrasting lenses; for instance, those who prioritize social equity may advocate for progressive taxation that poses higher rates on affluent individuals, believing it a just approach to finance public goods. In contrast, libertarians often emphasize personal freedom and individual rights, arguing against coercive taxation as a violation of property rights, thus viewing voluntary funding as a more ethical option. This ideological divide can lead to polarized discussions, ultimately shaping taxation policies based on the prevailing public opinion.

Social movements further influence perceptions of taxation, driving advocacy for reform or resistance against current tax structures. Grassroots movements some advocating for minimal government intervention, highlight their stance through campaigns that challenge the legitimacy of coercive taxation. These movements can galvanize public support and lead to significant changes in tax practices, pushing for transparency and equitable distribution of tax burdens. In summary, public opinion significantly affects taxation debates; understanding this influence is crucial to analyzing the dynamics of coercive taxation and its acceptance in society.

Conclusion: Toward a Balanced Approach to Taxation

The discussion surrounding taxation encompasses a spectrum of ethical considerations and economic realities that demand careful analysis. At the core of this debate lies the contentious notion of coercive taxation, often labeled as “taxation is theft” by critics who argue that the imposition of taxes undermines individual freedom and autonomy. This perspective raises significant questions about the legitimacy of taxing authorities and the moral implications of compulsory contributions to public finance.

Furthermore, the evolving economic landscape inevitably influences the effectiveness and fairness of taxation systems. The need for reform in public finance is pressing, as citizens increasingly question the allocation of their tax contributions. To maintain social order and support necessary public services, it is crucial to strike a balance between essential funding and ethical considerations. A shift toward models based on voluntary funding could present a viable alternative, allowing individuals to contribute based on their values and priorities, fostering a sense of community responsibility.

This potential transition towards voluntary funding also calls for a radical reconsideration of how public finance operates, emphasizing transparency and accountability from governing bodies. Innovative approaches that integrate citizens’ input in budgetary processes may enhance trust and cooperation, mitigating the negative perceptions associated with coercive taxation. By exploring alternative frameworks, societies can navigate the complex interplay of obligations and rights inherent in taxation.

Ultimately, encouraging dialogue around these reformative pathways is essential for developing a taxation system that acknowledges both ethical responsibilities and economic necessities. This balanced approach will ensure that taxation retains its role as a foundational element of societal cooperation without infringing upon individual freedoms.

- Trump Transition Picks, Amazon AI Hardware, More

- The week ahead in Asia

- Huawei to launch smartphone with own software in latest sign of China-US splintering

- UK business cutting back growth plans after Budget tax rises, warns CBI

- Half of British Firms Will Cut Jobs After Budget Tax Hikes, CBI Says

- Trump Transition Follow Up, Earnings Preview, More

- Trump Cabinet Background Checks, Inflation Outlook, More

- Trump Cabinet Picks Reactions, Markets Week Ahead, More

- US retailers stretch out Black Friday deals to lure flagging shoppers

- ‘Wicked’ and ‘Gladiator II’ give Hollywood hope for strong holiday box office

- New Universal Theme Park Featuring Mario And Harry Potter Opens In May—Here’s What We Know

- 13 Best Flower Delivery Services To Show Your Love From Miles Away

- What We Know About The Nicki Minaj-Megan Thee Stallion Feud—From ‘Hiss’ To ‘Big Foot’

- Taylor Swift At The Super Bowl: The Conspiracy Theory, Explained

- Crypto Is Suddenly Braced For A Huge China Earthquake After Bitcoin, Ethereum, XRP And Solana Price Surge